Climate change questions don't get more fundamental than this one: How much time is left to act before it is too late?

Right now the difficulty of answering that question is showing up in a place where many individuals are heavily invested in getting the answer right: The index funds responsible for meeting millions of Americans personal financial goals, from saving for a house, to a child's education, and a secure retirement.

Before he died, Vanguard Group founder Jack Bogle said one of the biggest issues the index fund would face in the future is its societal influence. Specifically, he meant the need to vote proxies on complex issues such as sustainability at annual meetings held by every publicly traded company and on behalf of so many individual fund shareholders.

BlackRock, the world's largest asset manager, and Vanguard Group, the creator of the index fund, manage more than $11 trillion combined. Just in ETFs, they manage roughly $2.5 trillion. And their market influence continues to grow: Vanguard has attracted roughly $1 trillion in the past three years alone.

"Larger mutual funds companies, like Vanguard, Fidelity, BlackRock and State Street Global Advisors, can move the market," said Mindy Lubber, CEO and president of Ceres, a nonprofit organization that works with big investors and companies on sustainability. "They can take a shareholder resolution from 10 percent to 40 percent."

In 2017 both companies voted to require ExxonMobil to produce a report on climate change, a watershed moment showing what can occur when index funds punch their weight in proxy voting.

Yet shareholder advocates say there have not been nearly enough of those ExxonMobil vote moments.

Big funds in the bottom quartile

A data analysis released by Ceres in early March shows that when BlackRock and Vanguard are measured on their up-or-down votes on climate change resolutions at stockholder annual meetings, they have among the worst voting records in the fund industry.

Rob Berridge, director of shareholder engagement at Ceres, said when the group ran the numbers on 2018 proxy voting, there was plenty of reason for encouragement, just not among the biggest fund companies.

"The overall trends are positive," Berridge said. "More firms are above 50 percent for resolutions.

"The surprise is that the biggest firms aren't among those above 50 percent," he added. "Index funds are the ultimate long-term diversified investors, and it is in their interest to ask companies to address climate.

"They need ExxonMobil to be in business in 50 years."

Many are not even close to the 50 percent mark.

Among 48 large fund companies that Ceres included in its review of up-or-down votes on climate-related shareholder proposals, Vanguard finished 42nd (voting for climate proposals 12 percent of the time), and BlackRock finished 43rd (voting in favor of these resolutions 10 percent of the time). T. Rowe Price Group, Putnam Investments and financial advisor favorite Dimensional Fund Advisors were all below BlackRock and Vanguard.

"It is unfortunate that the biggest firms are at the bottom of the list," Lubber said. "When they vote proxies, as they did on Exxon, the votes changed substantially and the conversations do get started, at least."

Fund companies say proxy votes aren't everything

The fund companies can't argue with the data, but they do argue with placing all the importance on proxy votes. Both BlackRock and Vanguard are among the companies with corporate stewardship departments that focus on engagement with corporations on issues from climate change to executive pay and human rights.

A Vanguard spokeswoman said that its Investment Stewardship team views voting proxies as one piece of a broader engagement strategy that also includes discussion with company boards and management and advocating on behalf of all shareholders.

"A vote against a shareholder proposal does not always indicate we disagree with the broader issue. ... As near-permanent investors intently focused on the long term, we engage with companies over the course of years, not weeks or months."

Sign Up for Our Newsletter Your Wealth Weekly advice on managing your money SIGN UP NOW Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy. .investigation-wrapper .description{ text-align:center; padding-bottom:15px; } .nl-privacy{ font-size: 10px; padding-top: 20px; display:block; } .wildcard .investigation-wrapper { -webkit-box-shadow: 0px 0px 4px 0px #999999; /* Android 2.3+, iOS 4.0.2-4.2, Safari 3-4 */ box-shadow: 5px 5px 5px 0px #999989; } .subsection .investigation{ background: #efefef; border-radius: 3px; padding: 10px 20px 20px 20px; } .investigation small{white-space:normal;} .subsection .investigation h1{ text-transform: uppercase; text-align: center; font-family: "Gotham Narrow Ssm 5r"; margin-bottom: 0px; padding-bottom:0px; font-size: 18px; margin-top: 10px; word-spacing: 1.5px; color: #333333; } .subsection .investigation .headline_title { font-size: 28px; padding-top: 20px; display: block; font-family: "Gotham Narrow Ssm 7r"; padding-bottom:5px; } .subsection .email-info { background: rgba(74, 144, 226, 1); max-width: 140px; margin: 0px auto; text-align: center; padding: 6px 1px; color: #fff; border-radius: 5px; } .subsection .email-info { color:#fff; } .subsection .email-info:hover{ background: #2077B6; } body .subsection.investigation-wrapper{overflow:visible;}

Vanguard pointed to its Investment Stewardship report, which listed engagements with more than 700 portfolio companies, 200 of which are involved in carbon-intensive industries.

BlackRock declined to comment, referring questions to its published materials, which include its approach to corporate stewardship, its most recent stewardship annual report discussing climate change and a full voting history that includes a list of companies with which it engages.

But here's the problem: Disclosure of a proxy vote is black and white; disclosure of ongoing engagement is not.

Shareholder advocates say these lists may be long in the number of companies engaged, but fund shareholders don't know who specifically was engaged at the companies and what policy changes were offered as a result of the fund companies' efforts.

Wide gap in progress between big funds over three years

Jackie Cook, a specialist in corporate environmental, social and governance (ESG) disclosure analysis and founder of FundVotes, which was acquired last year by Morningstar, said the "engagement first, voting later" rationale doesn't add up, because there is no reason why these companies can't do both. And the engagements suffer from a lack of transparency. "There is no standard disclosure structure," Cook said. "No one shows any granularity to the engagement. ... We want more transparency from the fund managers."

A broad data set that Cook has compiled over the past three years — the Ceres report is based on her analysis but uses a more narrow definition for climate-related proposals — shows that in 2016 neither Vanguard nor BlackRock voted in favor of any climate change proposal. In 2017 they voted in favor of 4 percent. State Street Global Advisors, by contrast, voted for 38 percent of climate proposals in 2016 and 45 percent last year. Fidelity Investments went from voting in favor of no climate change proposals in 2016 to voting in favor of 45 percent last year.

The fund companies counter with what amounts to a catch-22: They can't talk more openly about their engagement, because the nature of engagement precludes them from doing so.

"We believe that Vanguard and portfolio companies need to have candid, direct dialogue, so we don't publicly disclose specific details about particular engagements," the Vanguard spokeswoman said.

A report Cook published for Morningstar last Friday found something else disappointing. Socially responsible funds specifically created by these managers to target issues such as climate change don't always vote in support of climate resolutions, either. The BlackRock Impact U.S. Equity (BIRAX) voted against three greenhouse-gas and climate change shareholder proposals in 2018, including two that called for greater greenhouse-gas disclosure from oil and gas companies Chevron and Range Resources.

The FundVotes' analysis found that environmental, social and governance funds from Vanguard, Fidelity Investments and TIAA-CREF, among others, cast a number of votes that seemingly conflict with an ESG mandate, including funds specifically aimed at the environment.

"The main reason to have oil and gas companies in an 'impact fund' should be to improve the climate-related performance. ... Proxy voting is an obvious, simple way to do that," Berridge said.

Funds do need to go beyond proxy voting and engage with these companies as part of their impact investing mandate, but he said, "Voting in conflict with an ESG mandate should raise red flags, above and beyond the red flags associated with not voting for these resolutions in a non-ESG fund."

The first climate change bankruptcy

Tim Smith, director of ESG shareowner engagement at Walden Asset Management, which has specialized in socially responsible investing and shareholder advocacy for decades, said there is a disconnect between BlackRock CEO Larry Fink's words on corporate stewardship and his firm's actions.

"Larry talks about being deeply concerned and how he understands climate change, but the voting record is still backward-looking. They can argue they are engaging with management, but you don't end up voting only 10 percent of the time against management when you are engaging with this."

Another thing that BlackRock and Vanguard have not done, even as they point to weakness in shareholder proposals as a reason for voting against them: offer their own shareholder proposals on issues such as climate change.

"They still need to up their game, because the situation is urgent. We don't have a calm five- year waiting period." -Tim Smith, Walden Asset Management

For shareholder advocates, there simply isn't enough time to debate the relative merits of long-term dialogue versus the annual proxy voting power: Climate change is a material risk to corporate value today. Lubber pointed to a market event that recently occurred but not long ago would have been unthinkable: a highly regulated, "safe" utility company, PG&E, going bankrupt as a result of unprecedented California wildfire liabilities. "Two years ago people would have said that was unreasonable, an absurd proposition."

"We need to see progress — material progress," Lubber said. "Having 2,000 or 5,000 engagements that nobody knows what is happening doesn't reflect the urgency of the problem. Given the dialogue that Larry Fink has put out in the public domain, his lofty, thoughtful quarterly letters, one would expect to see more consistency in their voting of proxies. Larry has said these issues matter, but there is only one way for them to matter."

The proxy season is just beginning across corporate America, and climate-related proposals are again expected to be a major push among shareholder advocates. According to an analysis of proxies from shareholder advocate As You Sow that was released last Tuesday, climate change and corporate political influence spending are the top investor concerns in about half the proposals filed so far.

In an annual letter line from 2017 that has been quoted often, Fink wrote that BlackRock is patient on behalf of its long-term investors, but that does not mean it is "infinitely patient," and there does come a time to vote against management when long-term value is at risk.

"I respect the pressure that their voice as world's largest money manager brings. It is quite significant and should not be dismissed. ... But they still need to up their game, because the situation is urgent," Smith said. "We don't have a calm five- year waiting period."

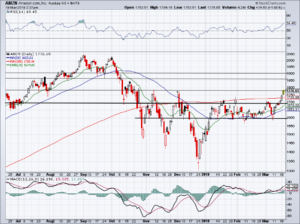

Over the last month, shares of Boeing Co. (NYSE: BA) have fallen over 15% as the company battled controversy following the crashes of its Boeing 737 Max 8 airliner.

Over the last month, shares of Boeing Co. (NYSE: BA) have fallen over 15% as the company battled controversy following the crashes of its Boeing 737 Max 8 airliner..1552680783073.jpg)

Semi stocks' 2019 win streak shows signs of snapping, economic forecaster warns 5:34 PM ET Fri, 15 March 2019 | 03:38 Disclaimer

Semi stocks' 2019 win streak shows signs of snapping, economic forecaster warns 5:34 PM ET Fri, 15 March 2019 | 03:38 Disclaimer

Source: Shutterstock

Source: Shutterstock  ChinaNet Online Holdings, Inc., through its subsidiaries, operates an integrated service platform that provides advertising and marketing services in the People's Republic of China. Its platform comprises CloundX, an omni-channel advertising and marketing system; and a data analysis management system. The company offers Internet advertising, precision marketing, and related data and value added services through its Internet advertising portals, including 28.com; and liansuo.com. It also produces and distributes television shows comprising advertisements. The company serves customers in the food and beverage, women accessories, footwear, apparel and garments, home goods and construction materials, environmental protection equipment, cosmetic and health care, education network, and other industries. ChinaNet Online Holdings, Inc. was founded in 2003 and is based in Beijing, the People's Republic of China.

ChinaNet Online Holdings, Inc., through its subsidiaries, operates an integrated service platform that provides advertising and marketing services in the People's Republic of China. Its platform comprises CloundX, an omni-channel advertising and marketing system; and a data analysis management system. The company offers Internet advertising, precision marketing, and related data and value added services through its Internet advertising portals, including 28.com; and liansuo.com. It also produces and distributes television shows comprising advertisements. The company serves customers in the food and beverage, women accessories, footwear, apparel and garments, home goods and construction materials, environmental protection equipment, cosmetic and health care, education network, and other industries. ChinaNet Online Holdings, Inc. was founded in 2003 and is based in Beijing, the People's Republic of China. The Trade Desk, Inc., a technology company, provides a self-service omnichannel software platform that enables clients to purchase and manage data-driven digital advertising campaigns in the United States and internationally. The company's platform allows clients to manage integrated advertising campaigns in various advertising channels and formats, including connected TV, mobile, video, audio, display, social, and native on various devices, such as smart TVs, computers, and mobile phones and tablets. It serves advertising agencies and other service providers for advertisers. The Trade Desk, Inc. was founded in 2009 and is headquartered in Ventura, California.

The Trade Desk, Inc., a technology company, provides a self-service omnichannel software platform that enables clients to purchase and manage data-driven digital advertising campaigns in the United States and internationally. The company's platform allows clients to manage integrated advertising campaigns in various advertising channels and formats, including connected TV, mobile, video, audio, display, social, and native on various devices, such as smart TVs, computers, and mobile phones and tablets. It serves advertising agencies and other service providers for advertisers. The Trade Desk, Inc. was founded in 2009 and is headquartered in Ventura, California. NEXT Financial Group Inc increased its position in Gerdau SA (NYSE:GGB) by 9.5% during the fourth quarter, HoldingsChannel reports. The institutional investor owned 34,500 shares of the basic materials company’s stock after purchasing an additional 3,000 shares during the period. NEXT Financial Group Inc’s holdings in Gerdau were worth $130,000 at the end of the most recent reporting period.

NEXT Financial Group Inc increased its position in Gerdau SA (NYSE:GGB) by 9.5% during the fourth quarter, HoldingsChannel reports. The institutional investor owned 34,500 shares of the basic materials company’s stock after purchasing an additional 3,000 shares during the period. NEXT Financial Group Inc’s holdings in Gerdau were worth $130,000 at the end of the most recent reporting period.